Common Life Insurance Considerations

Not sure where to begin? Here are a few questions to consider to get you started.

"I needed someone who could provide me with some direction during a time in my life that has many transitions! John and his crew were fabulous and made the process extremely simple!"

Amy Sanchez

"What an incredible and easy experience I had with G&G Independent Insurance. I was helped by Malik Ware. I recommend asking for his help. He was very insightful, detail-oriented, patient, and did a wonderful job of making me feel comfortable with the information I didn't understand. 5/5 highly recommend."

Ryan Parkey

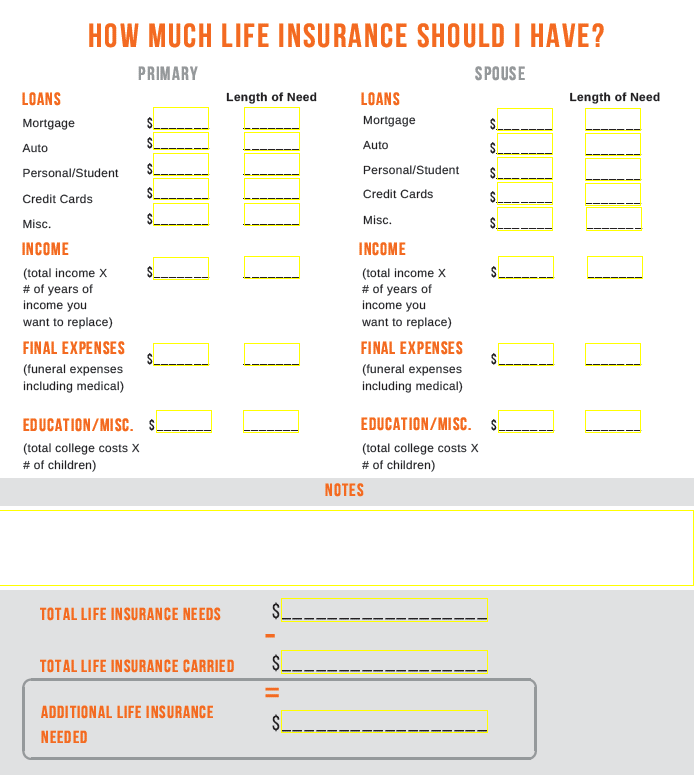

How Do I Estimate My Life Insurance Needs?

Calculation #1

A common, but simple way to estimate how much life insurance you need to buy is to multiply your gross (before tax) income by 10 to 15. Also, if you use this calculation, you can add $100,000 to the amount for each child's college education expenses.

Calculation #2

Another option to get a rough idea of how much life insurance you need is to use this formula:

- Sum up the immediate and future expenses your loved ones may incur if you were to pass. Expenses to include might be funeral costs, rent or mortgage, college tuition, etc.

- Add up any financial resources, such as a spouse's income, savings, or investments, that your loved ones would already have in place.

- Subtract your assets from the anticipated costs. The difference is the estimate of the life insurance you'd need.