Life insurance is a crucial financial tool that provides a safety net for individuals and their families. While many people focus on the death benefit aspect of life insurance, understanding the liquidity of a life insurance policy is equally important. In Arkansas, as in many other states, the liquidity of a life insurance policy can […]

Life Insurance

Life Insurance for Special Needs Adults

Life insurance is a critical tool for securing the financial future of families, particularly those with special needs family members. Planning life insurance for disabled adults is a crucial aspect of ensuring financial stability and peace of mind. In this blog post, we’ll delve into the significance of special needs life insurance coverage, the considerations […]

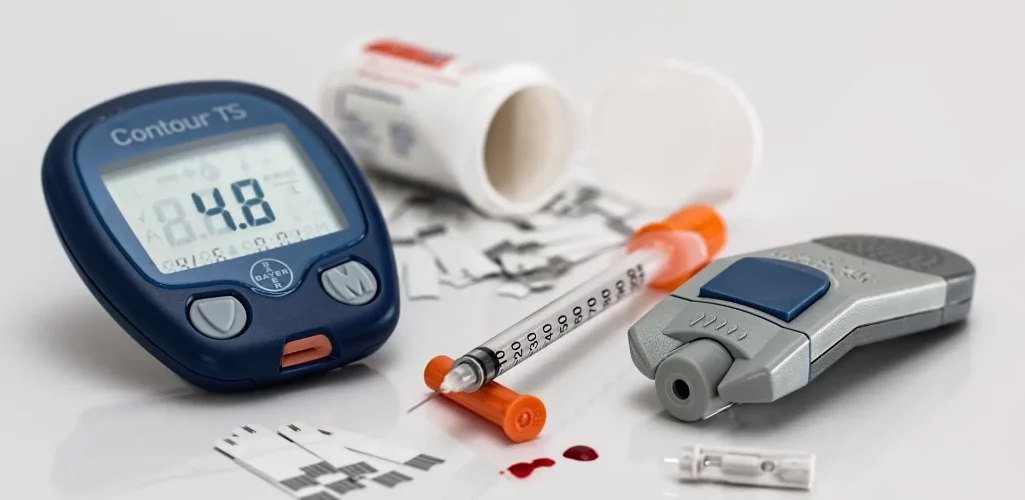

Can You Get Life Insurance For Diabetes?

Life insurance stands as a vital financial instrument, offering both tranquility and financial stability to your family in the unfortunate event of your demise. However, for individuals with pre-existing conditions such as diabetes, the process of obtaining life insurance may seem like a daunting task. In this comprehensive guide, we will explore the ins and […]

What Type Of Life Insurance Incorporates Flexible Premiums?

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their families. One of the most versatile and adaptive forms of life insurance is flexible premium life insurance. This type of policy offers policyholders the ability to customize their coverage and premium payments to suit their unique financial […]

Life Insurance Policy Riders in Fayetteville, AR: What Are They and Do You Need Them?

Life insurance is a vital financial tool that provides peace of mind and financial protection to families in Fayetteville, Arkansas, and across the United States. It serves as a safety net, ensuring that loved ones are taken care of in the event of the policyholder’s untimely death. However, not all life insurance policies are created […]

Can Nursing Homes Take Your Life Insurance From Your Beneficiary?

Nursing homes play a crucial role in providing care for elderly individuals who are unable to live independently. As part of planning for their future, many people opt for life insurance policies to secure financial stability for their loved ones after they pass away. However, a common concern that arises is whether nursing homes have […]

Life Insurance in Tulsa: Planning for Your Loved Ones

Life is unpredictable, and none of us can truly foresee what lies ahead. However, we can take steps to ensure that our loved ones are financially protected in the event of our untimely demise. One of the most effective ways to secure their future is through life insurance. In this blog post, we will delve […]

How to Get Life Insurance on a Sibling

Life insurance is a crucial part of financial planning that can provide a sense of security and protection for your loved ones in case of unexpected events. While most people consider getting life insurance for themselves or their spouse, it’s equally important to think about protecting your siblings. However, many people are not aware of […]

Can You Get Life Insurance with Cirrhosis of the Liver?

Cirrhosis of the liver is a serious condition that affects many people, and those diagnosed with it often wonder if they can still get life insurance. Life insurance is essential for providing financial security to loved ones after someone passes away. However, obtaining coverage with liver cirrhosis can be difficult. In this blog post, we […]

Is Afib Considered Heart Disease for Life Insurance?

Getting a new medical diagnosis can be scary, but sorting out life insurance in case of the worst-case scenario can be a great first step. Discover if AFib is considered a heart disease by insurance companies and how it can impact your life insurance coverage. Atrial fibrillation (AFib) is a common heart condition that can […]