Ah, life! Life is full of moments of wonderful memories, sunny days, and good times. But it also can be full of surprises. At G&G Independent Insurance we want to prepare you for life’s surprises, mishaps, and changes. These tips are designed to guide you in making the best decision on life insurance in Arkansas for you and your family.

Not much of a reader? Check out the video above for some quick advice on life insurance.

Understand Why Life Insurance is Necessary

Life insurance can be daunting to shop for, so let’s break down when and why life insurance is important to you. The purpose of life insurance is to provide financial support for your dependents if you are no longer around to do it yourself. If you have someone in your life that you contribute significantly to financially, you may want to consider purchasing. By knowing your personal and financial situation, you can begin shopping for your very own policy!

Know The Difference Between Term and Permanent Life Insurance

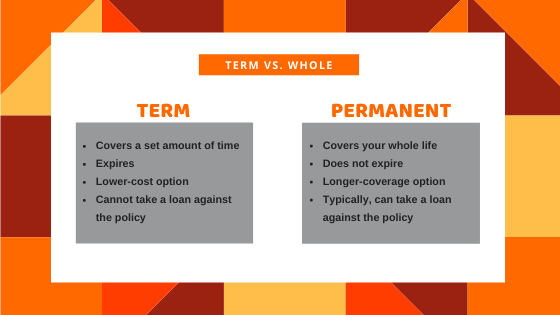

When shopping, you may find yourself buried in insurance lingo, foreign terms, and small print. Never fear, we’ll explain the details to you! There are two types of life insurance policies: permanent and term. As our wonderful and brilliant Account Specialist Stacy Wineland says,

“A permanent life policy is like buying a house and a term life policy is similar to renting.”

A permanent life policy is designed to address your concerns for an extended period. The policy does not expire, and it will continue to carry forward throughout your entire life as long as you pay the premium according to the contract.

The benefit of the plan is that you can invest a portion of your premium so that it is possible to meet financial goals. Furthermore, the insurer may allow you to take out a loan against the policy if you are facing a financial challenge.

Typically, term life insurance offers temporary protection for a specific period. If you die during that time, your beneficiaries receive the death benefit. If you are still alive at the end of the term, your coverage ends. A term life policy has the primary benefit of being a low-cost option when compared to a permanent life plan. The premium is usually less expensive, but it does not provide you the opportunity to invest or take a loan against the policy in an emergency.

The downsides associated with a term policy are primarily related to the duration of the plan. It will only provide funds if you die within the time that is covered. When the term expires, you will need to find a new policy.

Compare the Life Insurance Policies that are Best for You

Well, you’ve learned the lingo of life insurance. Now what? How do you pick a policy?

“Ideally, the need is greater at the beginning of the [person’s] career and when establishing a family. If the person plans properly and invests wisely, the need for life insurance decreases as they age due to liabilities being lower and their assets being great enough to cover final expenses and leaving a nest egg for any loved ones or dependents that remain.”

Plus, you may want to go with a term policy if your dependents will be financially independent shortly. You can set up your policy to finish its term when you think your kids will not rely on you financially.

Decide on How Much Life Insurance To Buy

Now that you have a policy in mind, it’s time to figure out how much to purchase. One thing to consider is how much money your dependents need each year and for how long. There are a few different ways you can calculate an estimate on life insurance quotes. Typically, six to 10 times the amount of your annual salary is reasonable. Also, another way to evaluate your needs is to multiply your annual salary by the number of years left until retirement. Let’s say, you are a 50-year-old man and you are currently making $40,000 a year. Using this approach, you would need a $600,000 policy if you retire at 65.

At the end of the day, only you know you. Compare the math of each type of policy, your financial ability to pay right now, and the amount you would want to leave for your dependents.

Phew, that was a lot to take in. Want to chat about what will work best for you? To learn more about our compare policies, give one of our Insurance Advisors a call at 479-802-0086 to receive quotes!

For a comprehensive guide on life insurance, explore this Forbes article covering 10 essential things you need to know about life insurance.

Based in Fayetteville, G&G Independent Insurance provides auto/car insurance, homeowners insurance, life insurance, business/commercial insurance, and bonds in the Northwest Arkansas region, including Fayetteville, Bentonville, Rogers, Bella Vista, and Springdale.